Make Medicare Changes Now

Posted on November 3, 2015 by bob in Medicare

“Shopping around may save you money or improve your coverage.”

Now’s the time for Alabamians with Medicare to look over their health and drug coverage for 2016. Medicare’s  annual open enrollment period runs through Dec. 7.

annual open enrollment period runs through Dec. 7.

Even if you’ve been satisfied with your health and drug plans, you may benefit from reviewing all your options. Some plans have adjusted their out-of-pocket costs and benefit packages for next year. Shopping around may save you money or improve your coverage.

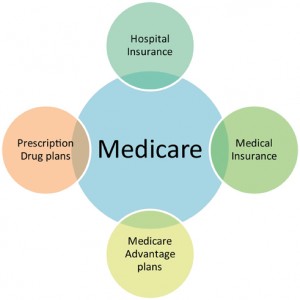

Here are five things to know as you sort through the many Medicare health and drug plans available for 2016.

Generally, health and drug plan premiums will be stable next year.

Alabamians in Medicare’s original fee-for-service program can choose from 24 drug plans with monthly premiums ranging from $18.40 to $117.20 — about the same premium range as last year. The average premiums for basic drug plans will inch up 91 cents to $32.50 per month.

Alabamians who prefer an alternative to the traditional Medicare program may join a Medicare Advantage health plan sold by a private insurer. You can select from among three to 16 health plans, depending on where you live in the state. Most plans include drug coverage. The average premiums for Medicare Advantage plans will drop 31 cents to $32.60 per month.

Look beyond premiums, though. The only way to determine the true cost of your coverage is to consider other factors like deductibles, co-payments and coinsurance. Medicare’s website — www.medicare.gov/find-a-plan — has the best tool for helping you narrow your search for a new health or drug plan.

Check the quality of a health or drug plan’s service, too.

To help you identify the best and worst Medicare plans in your area, www.medicare.gov/find-a-plan has provided star ratings for each. A gold star shows those plans with the highest, five-star rating. A warning icon alerts you to plans that have performed poorly for the past three years.

Higher-rated plans deliver a higher level of care, such as managing chronic conditions efficiently, screening for and preventing illnesses, and making sure people get much-needed prescriptions. Higher-rated plans also provide better customer service, with fewer complaints or long waits for care.

The well-publicized star ratings have spurred many health and drug plans to improve their performance over the last several years. About 65 percent of Medicare Advantage enrollees are now in health plans with four or more stars, a significant increase from 17 percent in 2009.

The well-publicized star ratings have spurred many health and drug plans to improve their performance over the last several years. About 65 percent of Medicare Advantage enrollees are now in health plans with four or more stars, a significant increase from 17 percent in 2009.

If you need help comparing health or drug plans, it’s readily available.

There are four places to turn for assistance:

— Visit www.medicare.gov/find-a-plan to compare your current coverage with new health or drug plans. If you want to make a change, the website will guide you to where to enroll in a new plan.

— Call Medicare’s help line at 1-800-633-4227 at any hour and talk with a customer service representative.

— Consult your “Medicare & You 2016” handbook, which you should have received in the mail in the last few weeks. The book may also be viewed at www.medicare.gov.

— Get one-on-one benefits counseling through your State Health Insurance Assistance Program. In Alabama, you may call 1-800-243-5463 for the counselors nearest you.

If you’re on a tight budget, see whether you can get help paying for your prescriptions.

If you’re having difficulty affording medications, you may qualify for the government’s “extra help” program. The amount of help depends on your income and resources. Generally, you’ll pay no more than $2.95 for each generic drug and $7.40 for each brand-name drug in 2016.

To qualify, your annual income can’t be more than $17,655 if you’re single or $23,895 if you’re married. Also, your resources can’t exceed $13,640 if you’re single or $27,250 if you’re married. Savings and investments count as resources, but homes, cars and personal belongings do not.

Thirty-seven percent of Alabamians with a Medicare drug plan get extra help. To apply, visit the Social Security website, at www.socialsecurity.gov/i1020, or call Social Security at 1-800-772-1213.

If you think you’ve been the victim of a plan’s deceptive marketing, report it.

Medicare closely monitors plans’ marketing activities to make sure they comply with the law. No one should have to put up with high-pressure sales tactics. If you believe you’ve been given incorrect or misleading information or enrolled in a drug or health plan without your consent, and you haven’t been able to resolve the issue with the plan, call Medicare at 1-800-633-4227 or send an email to surveillance@cms.hhs.gov.

There’s no better time to check your Medicare coverage. Any changes you make will take effect on Jan. 1.

Bob Moos is the Southwest public affairs officer for the U.S. Centers for Medicare and Medicaid Services.