Retirement Living on the Cheap

Posted on April 1, 2014 by bob in MoneyWise

Last month we looked at tax considerations that might impact your decision about where to live during retirement. From a tax standpoint the best nine states, in alphabetical order, appear to be: Alabama, Alaska, Delaware, Florida, Georgia, Louisiana, Mississippi, Nevada and Wyoming. Tax costs, however, are only part of the story when you compare the cost of residence across states.

Four significant expense categories besides taxes that vary based on where you live are: housing, healthcare, food, and utilities/energy. In some cases the difference in these can be sizable. Using data from a website called Sperling’s Best Places (www.bestplaces.net), I averaged the results for the three largest cities in each of the states listed above to create an index for comparison. (The results would be somewhat different if other cities were used.)

The biggest difference in cost is often housing. Evidently it runs a lot more in places like Alaska, Wyoming and Delaware than it does in the Southeast. The second biggest cost variance was for healthcare costs.

By far the most expensive state on the list is Alaska. On average it projects 56% higher costs than Alabama. Even Nome, the least expensive of the three cities checked, costs 37% more than Montgomery. The state on the list with the next highest cost of living was Delaware, which was 26% higher than Alabama. Wyoming was the third highest state on the list. The cost of living there is 15% more than ours. Unless you really like cold weather, these three might not have interested you anyway, but it’s nice to know that by avoiding their severe winters, you also enjoy generally lower costs.

Nevada, the other state on the list outside the Southeast, has the next highest increase vs. Alabama: 12%. While less objectionable from a cost standpoint than Alaska, Delaware or Wyoming, 12% is still a fairly hefty difference. For what it’s worth, I found little in Nevada to attract me during my two visits there. It is mostly desert—lots of beach with no ocean.

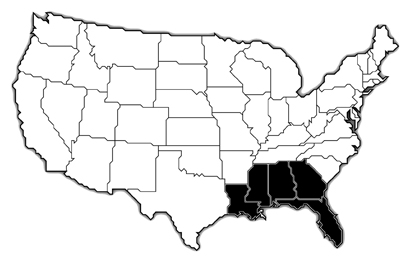

Where does that leave us? Five of the best nine states for retirees from a tax standpoint also have a fairly low cost of living. The overall cost index numbers for these five states, with the percentage increase compared to Alabama, are:

Alabama 85.7

Mississippi 88.3 3%

Florida 89.7 5%

Louisiana 92.0 7%

Georgia 93.3 9%

If any of these states is attractive to you for non-financial reasons, like being close to family or living on the beach, taxes and other costs should not be a big deterrent to relocating. However, you can often learn additional money-savings facts by doing further research yourself. For example, in a major city like Atlanta that covers multiple counties, the tax breaks given to seniors vary greatly by county. A senior in Atlanta may pay over 50% more in property taxes in one Atlanta county than he would if he owned a comparable property just a few hundred yards down the road.

While my method of averaging results for the three biggest cities in each state may provide a fair idea of general cost differences, you can examine the particulars more precisely by using the site mentioned above. Just plug in your current hometown and each alternate location that interests you. The site will give you an array of comparative cost information. In addition, you can use it to compare crime statistics, economic information, local demographics and weather. Although similar websites exist, Sperling seems to have data on more locations than the others.

Next month’s column will look at the next steps in evaluating alternate locations for retirement. Until then, happy planning.

Alan Wallace, CFA, ChFC, CLU is a Senior Financial Advisor for Ronald Blue & Co.’s Montgomery office, www.ronblue.com/location-al. He can be reached at 334-270-5960, or by e-mail at alan.wallace@ronblue.com.