Medicare Q&A

Posted on June 2, 2015 by bob in Medicare

Marci’s Medicare

Dear Marci,

I was recently contacted by a health insurance broker who asked for my Medicare number to see if I qualified for certain plans in my area. This sounded suspicious and I did not provide the information. What information are brokers and insurance plans allowed to collect from me? — Ralph

Dear Ralph,

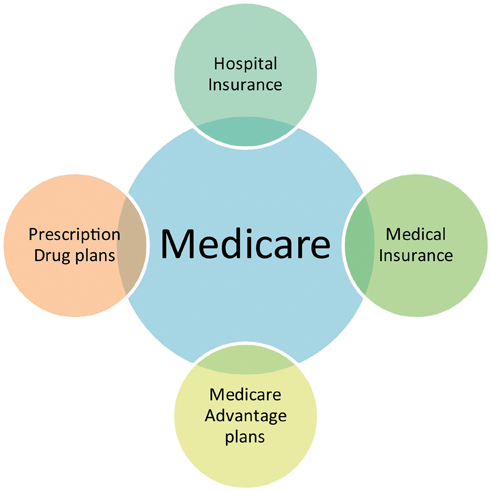

You were right to refuse the broker’s request for your Medicare number. Insurance companies that sell Medicare Advantage and  Part D plans must follow certain guidelines when promoting their products. The guidelines are meant to prevent plans from deceiving you – through marketing materials or through someone representing the plan — about what the plan offers and how much it costs.

Part D plans must follow certain guidelines when promoting their products. The guidelines are meant to prevent plans from deceiving you – through marketing materials or through someone representing the plan — about what the plan offers and how much it costs.

Companies can market plans through direct mail, radio, television, and print advertising. Agents can even visit your home under certain circumstances, but only if you have invited them. However, plans are prohibited from doing any of the following:

— Call you if you did not ask them to do so. Cold calling is not allowed.

— Send you unsolicited e-mails.

— Visit you in your home or nursing home without an invitation.

— Ask for your financial or personal information if they call you.

— Provide gifts or prizes worth more than $15 to encourage you to enroll.

— Disregard the National Do-Not-Call Registry and do not call again requests.

— Market their plans at educational events or in health care settings (except in common areas).

— Sell you life insurance or other non-health related products at the same appointment.

— Compare their plan to another plan by name in advertising materials.

— Include the term Medicare Endorsed or suggest that it is a preferred Medicare drug plan.

— Imply that they are calling on behalf of Medicare.

Protect your Medicare number the same way you would protect a credit card number. Only give your Medicare number or your Social Security number to your doctors and health care providers. Be careful about giving it to others, especially people who offer you a service for free.

Remember — Medicare or the Social Security Administration will not call you asking you for your personal information; they already have this on file. If you are unsure whether or not to provide information to a plan or broker, you can call 1-800-Medicare to confirm. Similarly, you can call 1-800-Medicare or your providers to confirm any plan benefit details.

Dear Marci,

My husband is planning on working past age 65, and he receives insurance through his job. In this situation, are we required to sign up for Medicare when we turn 65? — Judy

Dear Judy,

This depends on what kind of insurance your husband has. People with employer insurance from a current job may consider delaying Medicare enrollment as long as the employer coverage pays first and Medicare pays second. This employer insurance can be from either your own employment or the employment of a spouse.

If your husband works for an organization with 20 or more employees, this is considered to be large group health coverage. This large employer insurance will pay first and Medicare will pay second. If you have coverage from a large, current employer, you do not have to enroll in Medicare right when you turn 65. The employer coverage must pay for your care without regard to whether or not you have Medicare and you and your husband will have an eight month Special Enrollment Period (SEP) to enroll into Medicare as long as you have the employer coverage and within 8 months once you lose that insurance or retire. Before you decide to defer Part B, evaluate whether having additional coverage through Part B is worth the costs.

If your husband works for an organization with less than 20 employees, then this is considered to be small group health coverage. This small current employer insurance only pays after Medicare and can reduce or altogether deny benefits if you fail to enroll in Medicare. Because of this, if you have employer insurance from a small employer, you should enroll in Medicare as soon as you are eligible in order to maximize coverage and avoid significantly higher costs.

Know that these rules apply only when someone is actively working. Retiree insurance always pays after Medicare. If you have retiree insurance, you should sign up for Medicare as soon as you are eligible to do so in order to maximize coverage. If you do not, your retiree insurance can reduce or altogether deny benefits COBRA coverage also is secondary to Medicare; if you have COBRA when you become eligible for Medicare, you should sign up for Medicare as soon as you are eligible.

When making Medicare enrollment decisions, it is best to speak with your employer to find out how your coverage coordinates with Medicare. You also can speak with a Social Security representative at 800-772-1213. Be sure to write down the date, time, name of representative, and outcome of the call.

Marci’s Medicare Answers is a service of the Medicare Rights Center (www.medicarerights.org), the nation’s largest independent source of information and assistance for people with Medicare.